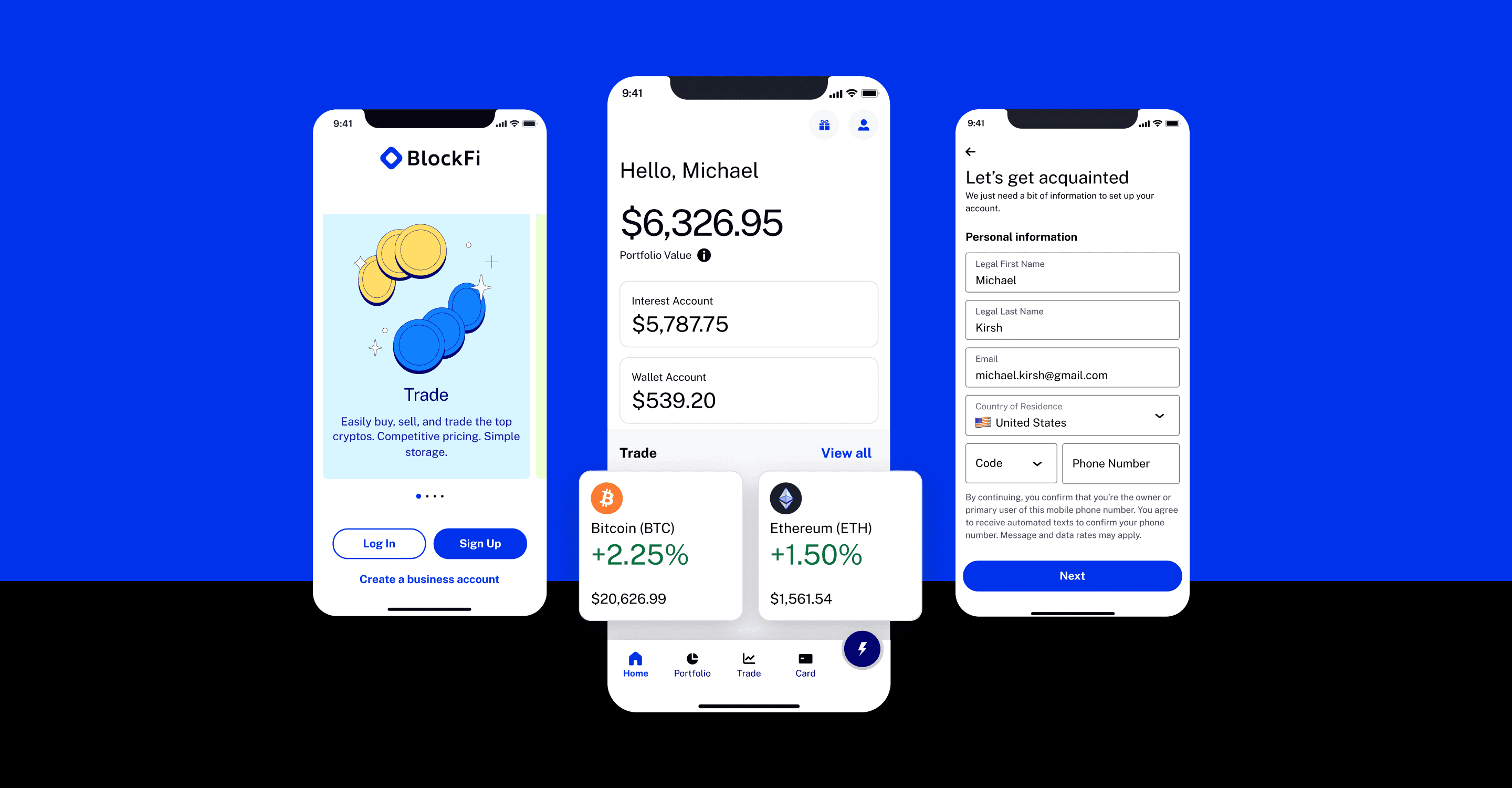

BlockFi

A platform that redefines the future of banking where users can earn interest, borrow cash, and trade crypto from financial services providers.

role

design lead

squad

Onboarding & activations

team

Product Manager, Engineering (FE & BE)

Research, Content Strategist, QA

Streamlining onboarding

Clients today experience onboarding as “a necessary evil” to endure vs an experience that supports their investment goals. Users have to go through over 20 screens before they can even add money to the platform.

Business value:

Increase # of clients who can immediately begin using our services.

• Drives 925K new accounts.

• Add $1.5M in revenue for newly acquired US clients.

• Save $76K on FTE headcount for manual KYC reviews by decreasing # of manual workflow events.

- Estimate 10%+ increase in conversion for US.

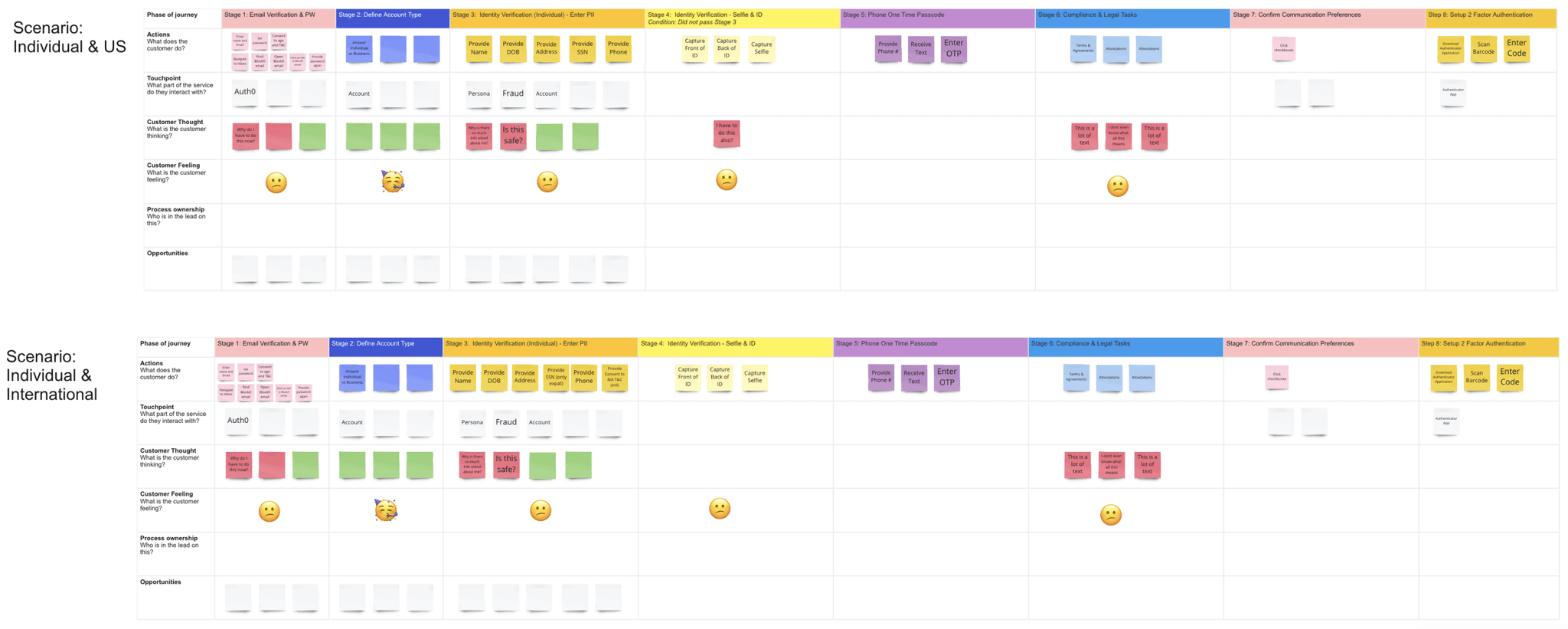

Where is the drop off happening?

The redesign streamlined BlockFi’s onboarding and verification flows, improving both user experience and operational efficiency. By reducing friction and introducing new data partners, we increased conversion, boosted revenue, and lowered the cost of manual review across the funnel.

To overhaul the onboarding experience, I started by completing a full UX audit, scrutinizing every screen and taking note of potential opportunities for improvement.

I worked closely with product managers and engineers to develop a detailed map documenting all the different touchpoints in the customer journey. This overview provided the necessary clarity for our team to make important strategic decisions. Syncs with engineering were crucial to understanding any constraints and what’s technically feasible within the timeline.

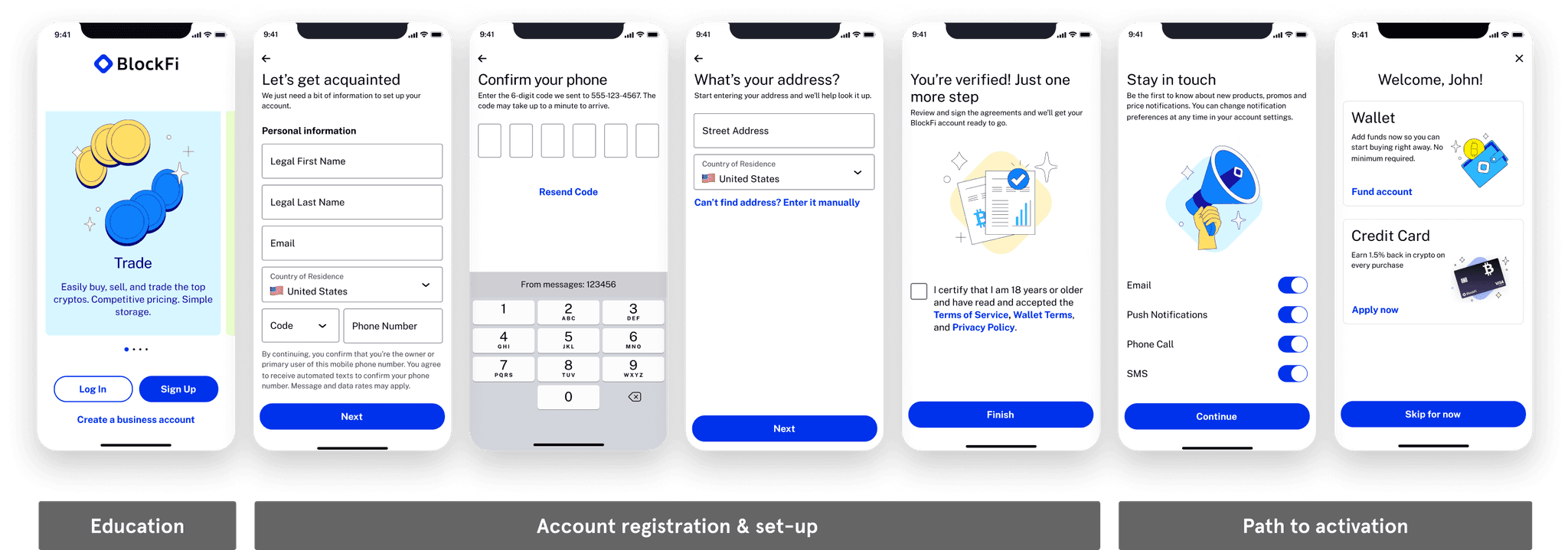

The happy path flow

The end results was an easy, quick, streamlined, personalized experience that set clients up for success (and hints at the next action) by only asking for necessary info, using geo-location, and prefilled form fields all helped convey the value of the process. By overhauling onboarding for web and mobile applications,

it enabled a 66% decrease in # of pages/form fields required and an improvement in KYC coverage and accuracy of new data partners.

Improvements

• The splash screen is a moment to educate the user. I wanted to make sure clients understand the value props around our different products and features Ex. Trade, Loans, Earning, and Investing.

• All major identifiers (PII) are on the initial page allowing more time for background verification and fraud checks: Full name, email, and mobile.

• Offloading the address to its own page gives more breathing room and doesn’t interfere with other questions or overwhelm.

• Consolidated T&Cs to own page for a final declaration of action.

• Buttons hug content, making them more reachable by thumb.

The Unhappy path flow

By replacing Persona and integrating with 3rd party vendors, Telesign, Lexisnexis, and Sentilink, our verification process becomes more seamless and in the background with the outlook of only having 10% of users going through the unhappy path of further verification.

The experience was considered standard by most participants and the length of the flow was as expected for most participants.

• No major usability or comprehension challenge was observed.

• Those who had concerns about providing SSNs called out that trust in the platform is a key factor when deciding whether to provide the info or not.

The goal of onboarding is to get clients on the platform, integrated, and using the products as soon as possible. It can be deduced and confirmed that since were no usability or comprehension issues, and the flow was cut down by more than half, the original screens were a massive friction point for users and deemed unnecessary for the user.

Since Trust was a point users called out during testing we added a Trust value prop to the carousel on the splash screen.

This concept let users manually prioritize and rearrange withdrawal accounts via drag-and-drop. If users understand the value of an optimized withdrawal order, they’ll be more likely to upgrade or renew.

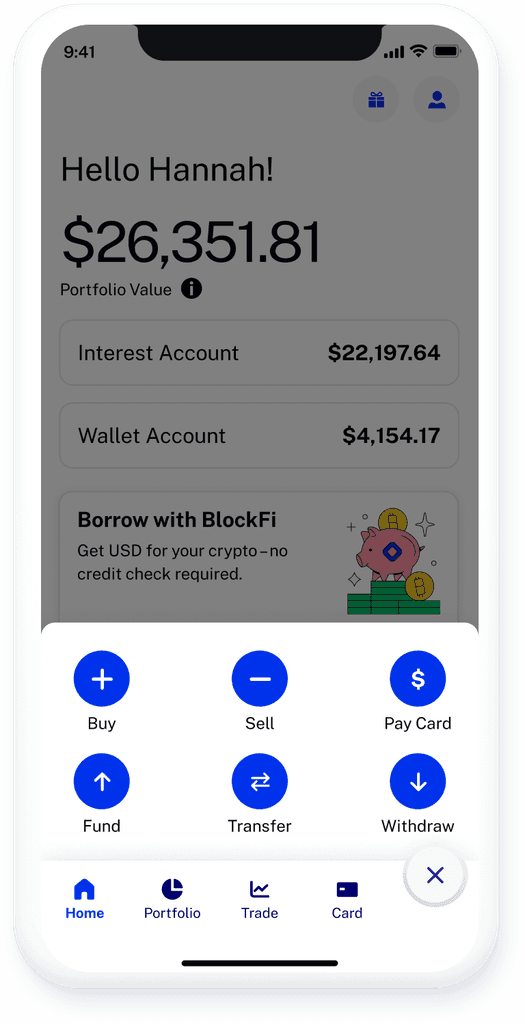

Home redesigned

Snapshot of a client’s financial health with insights, quick actions, and tailored suggestions driving engagement.

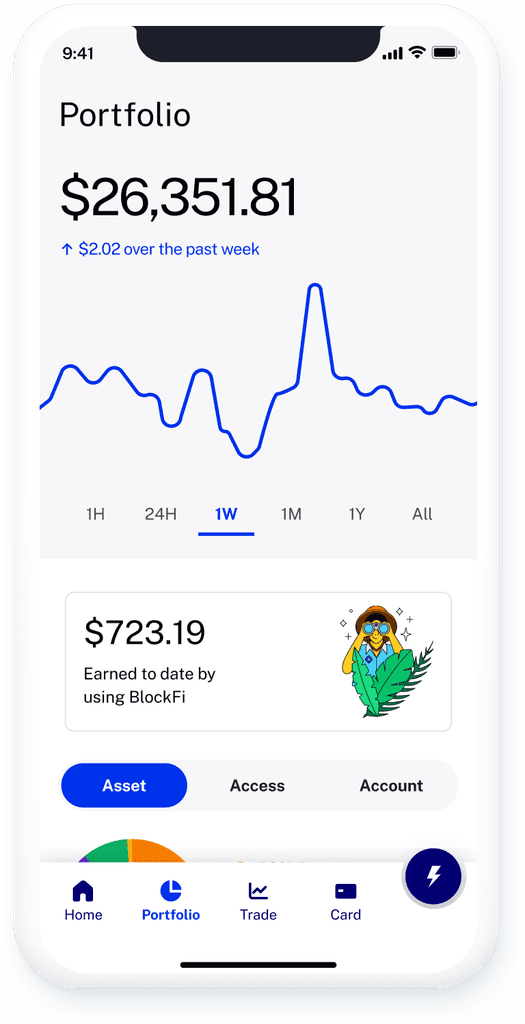

Portfolio

A clear overview of crypto assets, showing cross-portfolio data and detailed balances to guide key actions.

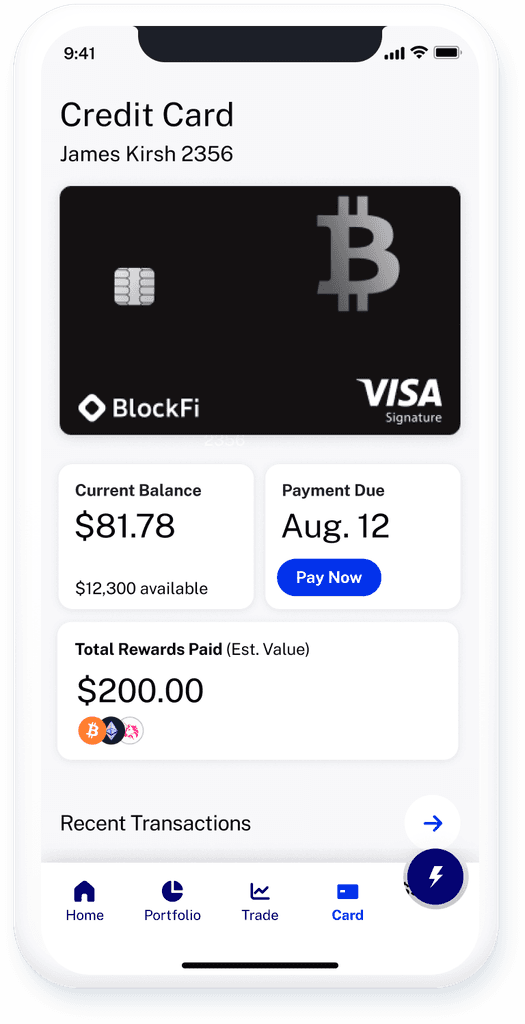

Credit Card

A clear, scannable snapshot of a client’s credit card health with balance, payment due, and rewards tracking.